Going through the loan repayment can be rather difficult, but knowing who to contact in such situations can make all the difference. If you have questions about repayment plans, your first point of contact should be your loan servicer or lender.

It doesn’t matter if you’re dealing with federal or private loans, these professionals can provide detailed information that are specific for your situation.

For federal student loans, contacting your assigned loan servicer can help clarify various repayment options, such as income-driven plans, deferment, or forbearance. Private loan borrowers often need to connect with their banks or lending institutions to understand the terms and explore suitable repayment plans.

Additionally, nonprofit credit counseling agencies and government resources can offer valuable advice and guidance. These organizations can help you run through your options and provide assistance with budgeting and financial planning to help you stay on track with your repayments.

Key Takeaways

- Contact your loan servicer for detailed, personalized repayment information.

- Federal and private loan repayment questions should be directed to the relevant servicer or lender.

- Nonprofit credit counseling and government resources can provide additional support.[/su_note]

How Repayment Plans Work

Repayment plans are essential for managing debt effectively, ensuring borrowers can meet their obligations without financial strain.

Having knowledge about the various options and their eligibility requirements helps borrowers make informed decisions about their financial future.

Overview of Repayment Options

Repayment plans can vary widely, accommodating different financial situations and repayment capabilities.

- Standard Repayment Plan: Fixed monthly payments over a set period, typically 10 years.

- Graduated Repayment Plan: Payments start low and increase every two years.

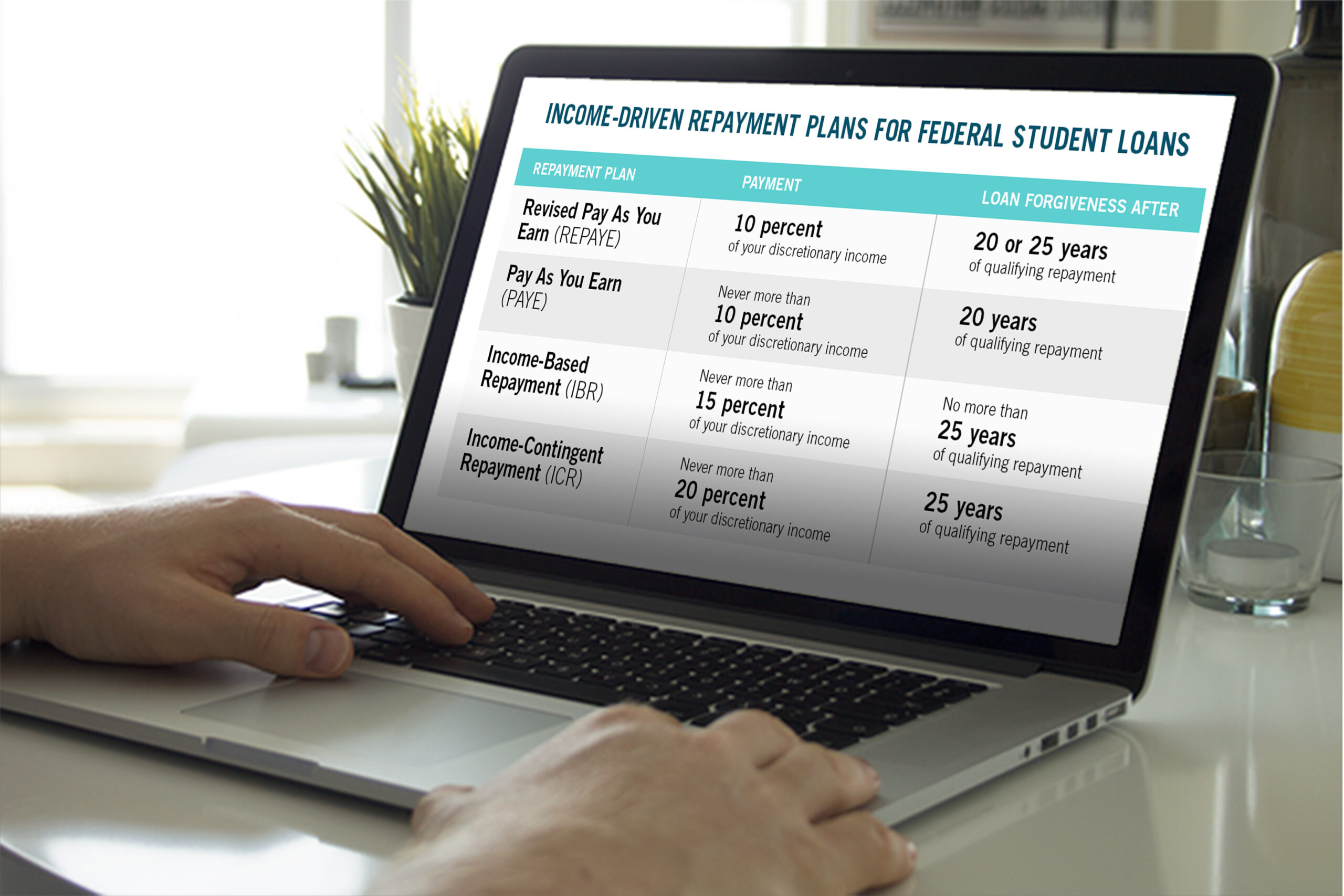

- Income-Driven Repayment Plans: Monthly payments based on income and family size, including options like Income-Based Repayment (IBR) and Pay As You Earn (PAYE).

Each plan has unique benefits and drawbacks, with some offering loan forgiveness after a set period of qualifying payments. These plans are especially useful for borrowers with fluctuating incomes or those just starting their careers.

Eligibility Requirements for Different Plans

Eligibility for repayment plans depends on various factors, including loan type, income level, and employment status. For instance, federal student loan borrowers may qualify for income-driven plans if their monthly payments under a standard plan are unaffordable.

- Income-Driven Plans often require proof of income and family size. Borrowers must recertify annually to remain eligible.

- Graduated Plans may not have specific eligibility requirements but are designed for those expecting their income to increase steadily over time.

Federal loans typically offer more flexible repayment options compared to private loans, which may have stricter terms and fewer plans available.

Federal Loan Servicers

Federal loan servicers manage various aspects of student loans, including repayment plans and loan forgiveness options. Knowing who your loan servicer is and how to contact them is essential for managing your student loans effectively.

Identifying Your Loan Servicer

It is important to determine which federal loan servicer handles your loan. Borrowers can find this information by logging into the Federal Student Aid website. Each borrower is assigned a specific loan servicer that assists with managing their loans.

These servicers include major companies like Navient, Nelnet, and FedLoan Servicing. Borrowers receive notifications from their loan servicer after their loans are disbursed. The loan servicer handles billing, assists with repayment options, and provides customer service support.

Contact Information for Federal Loan Servicers

Contacting your federal loan servicer is essential for questions related to repayment plans or any issues that may arise. Borrowers can reach their loan servicer through various methods, including phone, email, and mail. For instance, Navient provides contact details on their official website.

Each servicer has dedicated customer service representatives to assist borrowers. It’s beneficial to keep their contact information handy. Below is a table summarizing contact methods:

| Loan Servicer | Phone Number | Website |

| Navient | 1-800-722-1300 | Navient |

| Nelnet | 1-888-486-4722 | Nelnet |

| FedLoan Servicing | 1-800-699-2908 | FedLoan |

Borrowers should use these contact methods for inquiries about repayment plans, loan forgiveness, and other loan-related matters.

Private Loan Lenders

Knowing the role and responsibilities of private loan lenders is of utmost importance. They provide essential services like loan issuance, repayment plans, and customer service, all unique to each lender.

Knowing Your Private Lender

Private lenders, unlike federal institutions, offer a range of loan products that vary in terms, interest rates, and qualification criteria. It’s important to identify your private lender by reviewing your loan documents and communications.

Most private lenders provide online portals where borrowers can access details about their accounts. Using these resources can help keep track of payments and due dates. In addition, knowing the difference between fixed and variable interest rates can impact long-term repayment plans and overall financial health.

Communicating With Private Lenders

Effective communication with private lenders is essential for managing your loan successfully. Borrowers should keep their lender’s contact information handy, including phone numbers and email addresses.

Most private lenders offer multiple channels for contact, such as phone support, email, and online chat. Setting up reminders or alerts for payments can also prevent missed deadlines. Clear communication can also help in negotiating payment plans or understanding loan forgiveness options, if available.

Nonprofit Credit Counseling

Nonprofit credit counseling can provide valuable assistance for individuals managing debt repayment. These services offer expert guidance and resources to help you understand and optimize your repayment plans. Repayment plans are not included in the most searched questions on Google in 2024.

Credit Counselors and Debt Specialists

Credit counselors and debt specialists are professionals who offer personalized advice. They assess your financial situation, help you create a budget, and provide strategies for debt repayment.

These counselors often work for nonprofit organizations and are trained to offer advice without selling financial products. This can ensure that their guidance is unbiased and focused solely on improving your financial health.

Finding Reputable Credit Counseling Services

Finding reputable credit counseling services is crucial. Look for agencies accredited by the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

Verify that the agency is a nonprofit, as this status typically indicates a focus on client welfare rather than profit. It’s also essential to check for any complaints with the Better Business Bureau (BBB) to ensure that the organization has a good standing.

Government Resources

Government resources for student loan repayment provide reliable and authoritative guidance. The Department of Education and the Consumer Financial Protection Bureau are two primary entities offering valuable assistance.

Department of Education

The Department of Education offers a range of repayment options for federal student loans. Borrowers can access income-driven repayment plans through their loan servicers. These plans adjust monthly payments based on income, making them affordable for many.

For specific questions, borrowers can visit the Federal Student Aid website. This site offers detailed instructions and contact information. Public Service Loan Forgiveness (PSLF) is another program managed by this department. It provides loan forgiveness for those employed by a government or non-profit organization after 120 qualifying payments.

Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau (CFPB) serves as another important resource for students. They offer tools and resources to understand various repayment options. The CFPB provides guides on income-contingent repayment plans and other alternatives.

Students can also reach out through the CFPB website for inquiries or complaints. Its online portal helps borrowers navigate the complexities of loan repayment. The Navient field experiment report is an example of the guidance offered, focusing on reducing barriers to enrollment in repayment plans.

They aim to provide transparent and understandable information for all borrowers.

Repayment Assistance Programs

Repayment assistance programs can provide support for individuals struggling to manage their student loan payments. These programs offer various repayment options and have specific eligibility criteria.

Details on Repayment Assistance

Repayment assistance programs aim to make loan repayment more affordable based on the borrower’s income and financial situation. Some popular federal programs include Income-Driven Repayment (IDR) plans, which cap monthly payments at a percentage of discretionary income.

There are also Public Service Loan Forgiveness (PSLF) programs available for borrowers working in qualifying public service jobs. Additionally, the Revised Pay As You Earn (REPAYE) plan, Pay As You Earn (PAYE), and Income-Based Repayment (IBR) plans are designed to lower monthly payments and extend repayment terms.

For borrowers seeking immediate relief, forbearance and deferment options may temporarily reduce or suspend payments, although interest may still accrue. State-specific programs, like the Michigan State Loan Repayment Program, provide targeted assistance depending on the borrower’s location and employment sector.

Qualifications for Assistance Programs

Eligibility for repayment assistance programs varies. Income-Driven Repayment plans require proof of income and family size, with annual recertification needed. To qualify for the Public Service Loan Forgiveness program, borrowers must be employed full-time by a qualifying public service employer and make 120 qualifying monthly payments under a qualifying repayment plan.

Direct Contact Best Practices

Engaging directly with the appropriate contacts for repayment plan inquiries requires preparation and follow-up. These practices ensure that the interaction is as productive and informative as possible.

Preparing for the Call or Meeting

Before contacting a lender or financial advisor, gather all pertinent documents. Loan agreements, repayment schedules, and financial statements should be at hand. Draft a list of specific questions or concerns.

This helps streamline the conversation and ensures all points are covered. Understand your financial situation. This includes knowing your current balance, interest rates, and the terms of your repayment plan.

Researching contact information and choosing the best method of communication—whether it be phone, email, or in-person—is crucial. If possible, find out the name of the person you will be speaking with. Personalizing the interaction can lead to a more engaging and effective conversation.

Follow-up Actions After Contact

After the initial contact, take detailed notes of the main points discussed. This helps in referencing and following up on specific details later. Send a follow-up email to confirm what was discussed and agreed upon. This ensures clarity and serves as a written record.

Evaluate the responses received and compare them to your financial plans. Adjust your repayment strategy if necessary. Keep track of agreed actions and deadlines in a planner or digital calendar.

This helps in managing timelines and obligations effectively. If further clarification or action is required, do not hesitate to reach out again. Repeated interactions can often lead to a better understanding and resolution.