In 2025, the United States is once again at the top of the global wealth pyramid.

From bustling Silicon Valley boardrooms to old-money estates and fast-moving crypto ventures, America’s elite class of billionaires is larger, richer, and more influential than ever.

But how many billionaires are we talking about, exactly? What do the numbers say? And where does all that wealth come from?

Let’s break down the billionaire stats for 2025 and look at what’s shaping the ultra-rich landscape in the U.S. today.

Table of Contents

ToggleHow Many Billionaires Are in the US in 2025?

According to Forbes’ 39th Annual World’s Billionaires List (published April 2025), there are 902 billionaires living in the United States.

That’s up from 813 the year before – an 11% increase in just 12 months. It’s the largest one-year jump in over a decade.

Quick Comparison

| Year | Number of US Billionaires | Source |

|---|---|---|

| 1990 | 66 | Statista |

| 2023 | 748 | Statista |

| 2024 | 813 | Forbes |

| 2025 | 902 | Forbes |

That 902 figure isn’t the only estimate floating around. The Hurun Global Rich List 2025 lists 870 U.S.-based billionaires, while some other financial trackers report ranges between 813 and 867.

These differences mostly come down to how wealth is calculated, things like whether private assets are included, how real estate is valued, or when stock prices were recorded.

Even with those small discrepancies, Forbes is considered the most trusted source year over year. So, for the purposes of clarity, 902 is the number to know.

How Much Are They Worth Altogether?

According to The Guardian, the combined net worth of the 902 billionaires in the United States totals $6.8 trillion.

That’s 42.2% of the total billionaire wealth worldwide, which sits at $16.1 trillion globally. To put it into context, the entire GDP of the United Kingdom in 2023 was about $3.3 trillion.

U.S. billionaires are holding double that, in personal wealth. Average net worth per billionaire in the U.S.? Around $7.54 billion.

Of course, that average is pulled upward by a few extremely wealthy individuals, those with more than $100 billion to their name.

How the US Compares Globally

Out of the 3,028 billionaires worldwide in 2025, the U.S. holds about 29.8% of them (per Oxfam). It’s the undisputed leader in sheer number and total wealth.

Here’s a quick global snapshot:

| Country | Number of Billionaires | Total Wealth (USD) |

|---|---|---|

| United States | 902 | $6.8 trillion |

| China (incl. Hong Kong) | 516 | Not specified |

| India | 205 | Not specified |

| Germany | 130 | Not specified |

| Russia | 110 | Not specified |

America’s lead is even more obvious when you look at centibillionaires, people worth more than $100 billion.

Thirteen out of the world’s fifteen centibillionaires are U.S. citizens.

Where Does the Money Come From?

According to The Heritage Foundation, a significant chunk of billionaire wealth in the U.S. is self-made. Globally, 67% of billionaires have built their fortunes themselves, up from 66% in 2024.

The U.S. strongly reflects that trend, with many of its wealthiest individuals being founders, inventors, and startup veterans. Let’s take a closer look at who’s at the top.

Top US Billionaires in 2025

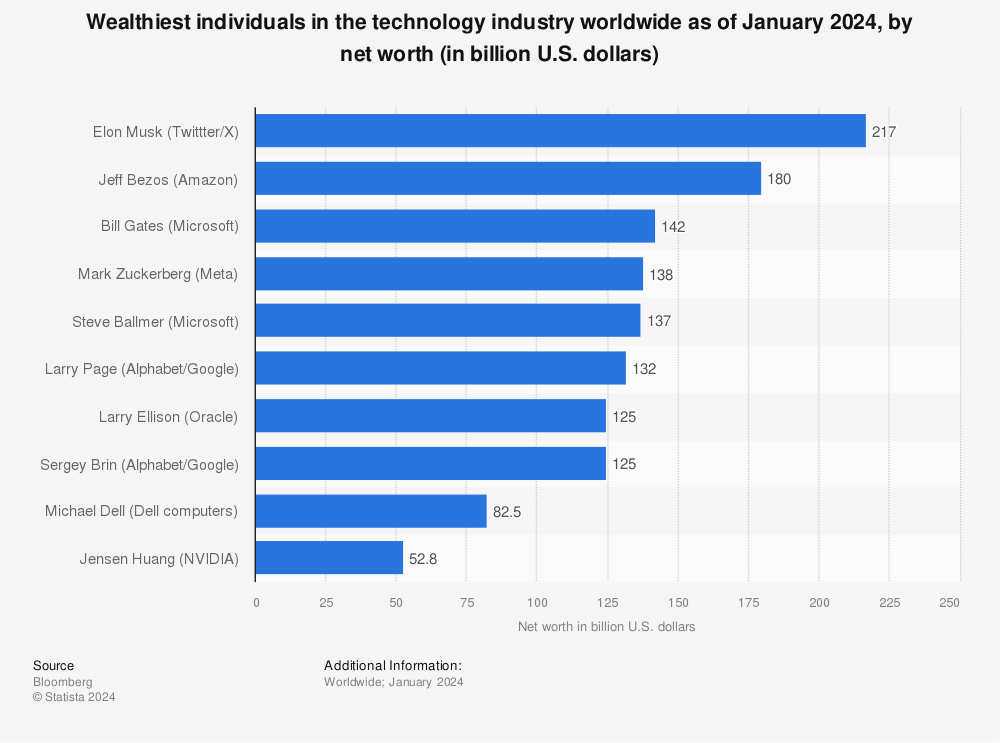

Technology is clearly the front-runner. The companies these individuals built, Tesla, Meta, Amazon, Oracle, Google, are not only massively profitable, but they’ve also changed how entire industries operate.

Other Notable Names

It’s not all tech, though. Plenty of billionaires made their fortune in other fields:

- Warren Buffett – $143 billion Industry: Investments, Berkshire Hathaway

- Donald Trump – $5.1 billion Industry: Real estate, media, cryptocurrency

- George Joseph – $1.9 billion Industry: Insurance (and yes, he’s 103 years old)

Trump’s net worth reportedly more than doubled in the past year due to shifts in valuation from his new media and crypto ventures.

Billionaire Demographics (Age, Gender, Background)

The average billionaire is still male and middle-aged, but the range is widening every year.

- Youngest self-made billionaire in the US: Alexandr Wang, 28, founder of Scale AI, worth around $2 billion.

- Oldest: George Joseph, 103, worth $1.9 billion.

Women are gaining visibility in billionaire rankings, too.

- Alice Walton (Walmart) and MacKenzie Scott (Amazon) remain among the richest American women.

- Globally, 113 self-made women billionaires are recorded, led by Swiss shipping mogul Rafaela Aponte-Diamant ($37.7 billion).

What Industries Create the Most US Billionaires?

While exact numbers per sector vary depending on methodology, several industries continue to dominate the billionaire pipeline in the U.S.

Leading Sectors

- Technology: From electric vehicles to AI, this sector has created a huge number of billionaires in just the last decade.

- Finance & Investments: Think hedge funds, private equity, and insurance empires.

- Retail: Both traditional players like Walmart heirs and digital retailers like Amazon are represented.

- Real Estate: High-rise developers, commercial landlords, and land tycoons still rank high.

- Manufacturing & Energy: Especially clean energy, which is gaining traction in 2025.

Billionaires vs. Everyone Else

Now for the elephant in the room. 902 people holding $6.8 trillion in wealth amounts to an extraordinary concentration of financial power, especially in a country with over 330 million residents.

That’s less than 0.0003% of the population holding a sum greater than the GDP of most countries. It’s an economic reality that fuels policy debates.

Should billionaires be taxed more heavily? Should there be more regulation on wealth transfers? Are we doing enough to balance innovation with equity?

That said, many billionaires do contribute significantly to public good-either through job creation, philanthropic initiatives, or both.

Examples

- MacKenzie Scott has donated billions to underfunded nonprofits and grassroots organizations.

- Elon Musk’s ventures in clean energy and space exploration are often cited as key to future innovation.

- Bill Gates, while no longer among the top five in net worth, continues to be a leading voice in global health and education.

What’s Driving Billionaire Growth in 2025?

Several forces are fueling the rise in billionaire numbers:

1. Stock Market Boom

Markets have remained strong, particularly in tech-heavy sectors. IPOs and stock-based compensation pushed many tech founders past the billion-dollar threshold.

2. AI and Emerging Tech

Artificial intelligence, automation, and biotech are creating entirely new categories of wealth.

3. Crypto and Digital Assets

Though volatile, cryptocurrencies and Web3 ventures continue to make and break fortunes overnight.

4. Clean Energy Innovation

The U.S. push toward decarbonization is birthing new energy billionaires in solar, battery technology, and sustainable infrastructure.

Could Billionaire Numbers Decline?

It’s possible, but unlikely in the short term. Potential factors that could slow or reverse growth:

- Market corrections or crashes

- Higher capital gains taxes and wealth taxes

- Stricter regulations on IPOs or cryptocurrency markets

- Geopolitical shifts that disrupt trade or innovation pipelines

Still, the U.S. has one of the most supportive environments for entrepreneurship, venture capital, and market access.

Unless there’s a seismic economic shift, the billionaire class is expected to keep expanding, though possibly at a slower pace.

Final Thoughts

In 2025, the United States is home to 902 billionaires, together holding a staggering $6.8 trillion. That’s more than double the entire GDP of the United Kingdom.

It’s also a 36% increase in billionaire count from just two years ago. While most of this wealth is built in tech, other industries-from real estate to finance-are still in play.

The U.S. billionaire landscape is diverse, dynamic, and deeply influential. It tells a story not just of money, but of entrepreneurship, innovation, and, increasingly, inequality.

Whether celebrated or scrutinized, billionaires remain a defining feature of the American economy. And in 2025, they’re more powerful than ever.

Related Posts:

- 13 Richest Cities in the US 2025 - Luxury, Money,…

- 25 Most Dangerous Cities in US - Updated Statistics for 2026

- Safest Countries in the World in 2025 - GPI…

- America's Murder Capitals: A 2026 Ranking of the…

- Capital Cities in Europe: Top Destinations For You…

- Senator Gillibrand Calls for Clear Rules on Digital…