Generational poverty doesn’t just show up in bank accounts. It’s in neighborhoods where kids grow up next to shuttered grocery stores. It’s in the jobs people can’t get, the schools that never had enough books, and the homes that never built equity.

For many Black families in the United States, poverty is a pattern that repeats itself, shaped by forces long in motion.

Even as civil rights protections grew stronger and new economic opportunities opened up, many of the roots stayed put. Today, millions of Black households still face financial instability not because they made poor choices, but because the system was built to keep them behind.

Let’s look at what keeps that cycle turning, not in theory, but in the very real, day-to-day forces that have been stacking the odds for generations.

Table of Contents

ToggleKey Highlights

- Generational poverty in Black households stems from systemic exclusion in housing, education, and labor.

- Inheritance gaps are massive: white households receive 8x more in family transfers than Black households.

- Redlining, underfunded schools, and mass incarceration continue to block economic mobility.

- Real change requires structural reforms, not just personal effort.

A Legacy You Can’t Save Your Way Out Of

Slavery stole futures. For over two centuries, Black Americans were legally barred from accumulating any kind of wealth. No wages. No land. No business ownership. When emancipation came in 1865, the starting line wasn’t even visible for most Black families.

Then came sharecropping, convict leasing, and Jim Crow laws. Each new chapter just found a different way to keep wealth out of reach.

Even when communities like Tulsa’s Greenwood District found a way to thrive, they were often met with violence or economic sabotage. The 1921 massacre of Black Wall Street wiped out an entire neighborhood’s economic foundation in a matter of days.

It didn’t stop there.

Federal programs that helped build the white middle class in the 20th century often left Black families behind. The New Deal excluded domestic and farm workers from Social Security. Those jobs, unsurprisingly, were heavily filled by Black laborers.

The GI Bill offered home loans and college tuition to veterans after World War II, unless you were Black. Discriminatory application processes and outright denial meant that many veterans who fought for their country were blocked from the very benefits designed to reward their service.

By 1947, veterans made up half of the national college population. But Black veterans were mostly pushed toward underfunded, segregated colleges. The long-term cost? Less education, less income, and less intergenerational mobility.

Why Wealth Isn’t Just About Income

Some people hear “poverty” and think about low paychecks. But generational poverty isn’t just about what someone earns today, it’s about what they didn’t inherit yesterday.

Let’s talk about housing first.

Homeownership and Redlining

Buying a home is the most common way families in the U.S. build wealth. Roughly two-thirds of median household wealth comes from home equity. But for Black families, that path has always come with roadblocks.

Redlining, the practice of denying loans and insurance to people in Black neighborhoods, didn’t just block homeownership. It trapped families in areas with lower property values, underfunded schools, and fewer services.

Even when Black families did manage to buy homes, those homes didn’t appreciate at the same rate as those in white neighborhoods. A study from the National Bureau of Economic Research found that even when you control for income and education, homes in Black neighborhoods grow in value more slowly.

“To close the racial wealth gap, we must address the compounded effects of redlining and predatory lending that kept Black families from building home equity. Creating fair access to mortgages and investing in historically undervalued neighborhoods are key steps toward restoring lost generational wealth” – says Latoria Williams, CEO of 1F Cash Advance and a leading voice on financial inclusion.

A generation later, many families are still recovering, or haven’t.

The Labor Market Still Isn’t Level

Black workers face a double burden: lower pay and fewer opportunities.

Manufacturing once offered decent, union-protected jobs that paid enough to raise a family. But as those jobs disappeared, many Black workers were left behind without a safety net. Between 1983 and 2016, Black household incomes were cut in half, while white incomes rose by a third.

It gets worse during economic downturns. According to American Progress, in the 2020 recession, white household wealth rose by 3.3%, while Black household wealth fell by 0.7%. Averages don’t tell the whole story, though. The average Black household had around $241,951 in wealth compared to $1.17 million for white households. It’s a chasm.

School Systems That Start Uneven and Stay Uneven

Public schools rely heavily on property taxes. That means schools in lower-income areas, including many historically Black neighborhoods, get less funding from the start.

Fewer counselors. Outdated textbooks. Overcrowded classrooms. Less access to advanced coursework. These disadvantages don’t just hurt kids in the moment. They ripple through the rest of their lives.

Black students are more likely to drop out of high school and less likely to graduate college. That limits access to higher-paying jobs and perpetuates the income gap. Even for students who do go to college, the financial burden tends to be heavier. Black graduates hold more student debt and take longer to pay it off.

The COVID-19 pandemic made those divides even clearer. Black students were more likely to lack access to reliable internet or quiet learning spaces during remote school, further setting back academic progress.

Inheritance Isn’t Just for the Rich

Even small transfers of wealth can change someone’s financial trajectory. A down payment gift. Help with student loans. Starting capital for a business. Most white families aren’t rich, but many still benefit from intergenerational help.

According to American Progress, between 2010 and 2019, white households aged 55–64 received an average of $101,354 in gifts and inheritances. For Black households in the same age range? Just $12,623.

Looking ahead, white households expect another $75,000 in transfers. Black households expect less than $3,000.

That kind of imbalance doesn’t go away with hard work. It means fewer safety nets, fewer investments in education or housing, and fewer chances to escape the cycle of poverty.

The typical Black family has just one-tenth the wealth of the typical white family. One in five has zero or negative net worth. And three-quarters have less than $10,000 saved for retirement.

Criminal Records and Lost Generations

Mass incarceration didn’t just lock up individuals. It locked out entire communities from economic progress.

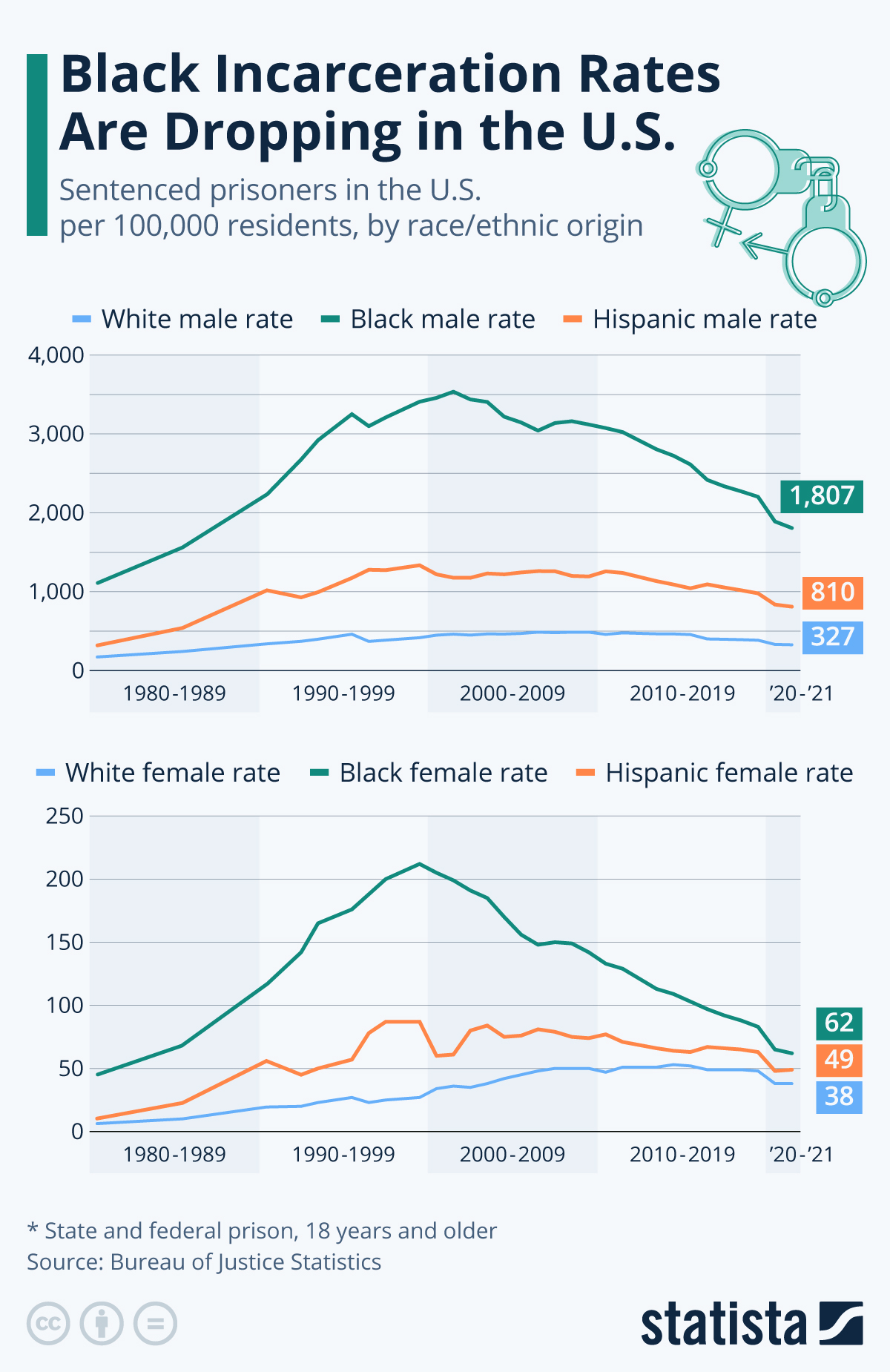

Black Americans are incarcerated at more than five times the rate of white Americans. The effects go far beyond prison time. A record can bar someone from jobs, housing, or even voting. It makes reentry into society punishing and often demoralizing.

And while someone’s serving time, families back home suffer too, emotionally and financially. Children of incarcerated parents are more likely to grow up in poverty, struggle in school, and encounter the justice system themselves.

Incarceration rates for Black men increased fourfold in the early 1900s and elevenfold by the 1980s. That didn’t just harm individuals. It destabilized entire family networks across multiple generations.

Health Gaps That Empty Wallets

Black Americans face higher rates of chronic illnesses like hypertension, asthma, and diabetes. These aren’t random outcomes. Many stem from where people live, what they have access to, and the quality of care they can afford.

Environmental factors play a role too. Many Black neighborhoods are in areas with higher pollution levels and fewer grocery stores offering fresh food. Health issues limit earning potential, increase out-of-pocket costs, and shorten lifespans, all of which shrink generational wealth.

COVID-19 was another blow. Black Americans were more likely to work essential jobs, which couldn’t be done remotely. That meant more exposure, more illness, and more missed paychecks.

By the Numbers

Here’s how generational poverty looks in hard numbers:

| Metric | Black Households | White Households |

|---|---|---|

| Three-generation poverty rate | 21.3% | 1.2% |

| Adults with poor grandparents | 59% | 9% |

| Upward mobility from bottom fifth | 42% | 56% |

| Downward mobility from middle fifth | 33% | 13% |

| Population in poverty (2022) | 20.1% | 13.5% (overall) |

The pattern is clear: Black families are more likely to start poor, stay poor, and see their children do the same. And it’s not because they aren’t trying. It’s because the rules of the game were never written with equity in mind.

What Actually Helps?

Tackling generational poverty isn’t about quick fixes. It takes a full-scale commitment to shifting how systems work. Some practical steps that experts recommend include:

Housing Access and Equity

- Enforce fair lending laws and end discriminatory real estate practices

- Build affordable housing in high-opportunity areas

- Offer first-time buyer programs with down payment assistance

Education That Levels the Field

- Increase funding for schools in underserved communities

- Expand access to early childhood education

- Provide targeted college readiness and mentorship programs

Economic Security

- Invest in job training tailored to high-growth industries

- Strengthen labor protections and support unionization

- Raise the federal minimum wage

Inheritance Equity

- Introduce baby bonds: trust accounts that grow over time for every child

- Expand access to 401(k) plans and retirement matching

- Offer tax credits for wealth-building activities like saving and investing

Criminal Justice Reform

- End mandatory minimum sentencing for non-violent offenses

- Support reentry programs focused on jobs and housing

- Eliminate barriers to expungement for non-violent records

Health Equity

- Expand Medicaid in all states

- Fund community health clinics in high-need areas

- Address food deserts and unsafe living conditions through targeted urban policy

Final Thoughts

Generational poverty in Black households isn’t about individual choices. It’s about structures that were built to exclude and systems that still fall short of repair. But the cycle isn’t unbreakable.

It takes real investment, smarter policies, and a shift in how the country values equity. Not charity. Not sympathy. Just fairness – in housing, in school funding, in lending, and in opportunity.

Breaking the cycle means building something better, not just for Black families, but for everyone who’s been kept at the margins for far too long.

Related Posts:

- Safest Countries in the World in 2025 - GPI…

- New Michigan SLAPP Style Law In 2026 - What Changes…

- Complete Guide to Social Support for Low-Income…

- What Is the Most Dangerous Country in the World in 2025

- Capital Cities in Europe: Top Destinations For You…

- What You Need To Know About the Equality Act in 2025